Double the Rewards This Holiday Season!

PLUS! Earn 3X Rewards Points on purchases made November 28 – December 1.*

Make the most of your holiday shopping and watch your rewards multiply!

*MCCU Mastercard Platinum Reward cardholders earn 2X (DOUBLE) rewards on qualified Retail net purchases from October 1–December 31, 2025. Purchases posted between November 28–December 1, 2025, earn 3X (TRIPLE) rewards instead of 2X. Points are added at the end of each billing cycle. Excluded transactions include, but are not limited to, airlines, travel services, car rentals, lodging, package travel, cash advances, person-to-person transfers (e.g., Venmo, Zelle, PayPal, Apple Cash, Google Pay Send) processed as cash advances, purchases over the credit limit, balance transfers, and closed accounts. Other restrictions may apply. All purchases are subject to credit approval. Terms and conditions may change; see MonroeCommunityCU.org/Credit Cards for details.

MCCU Credit Cards

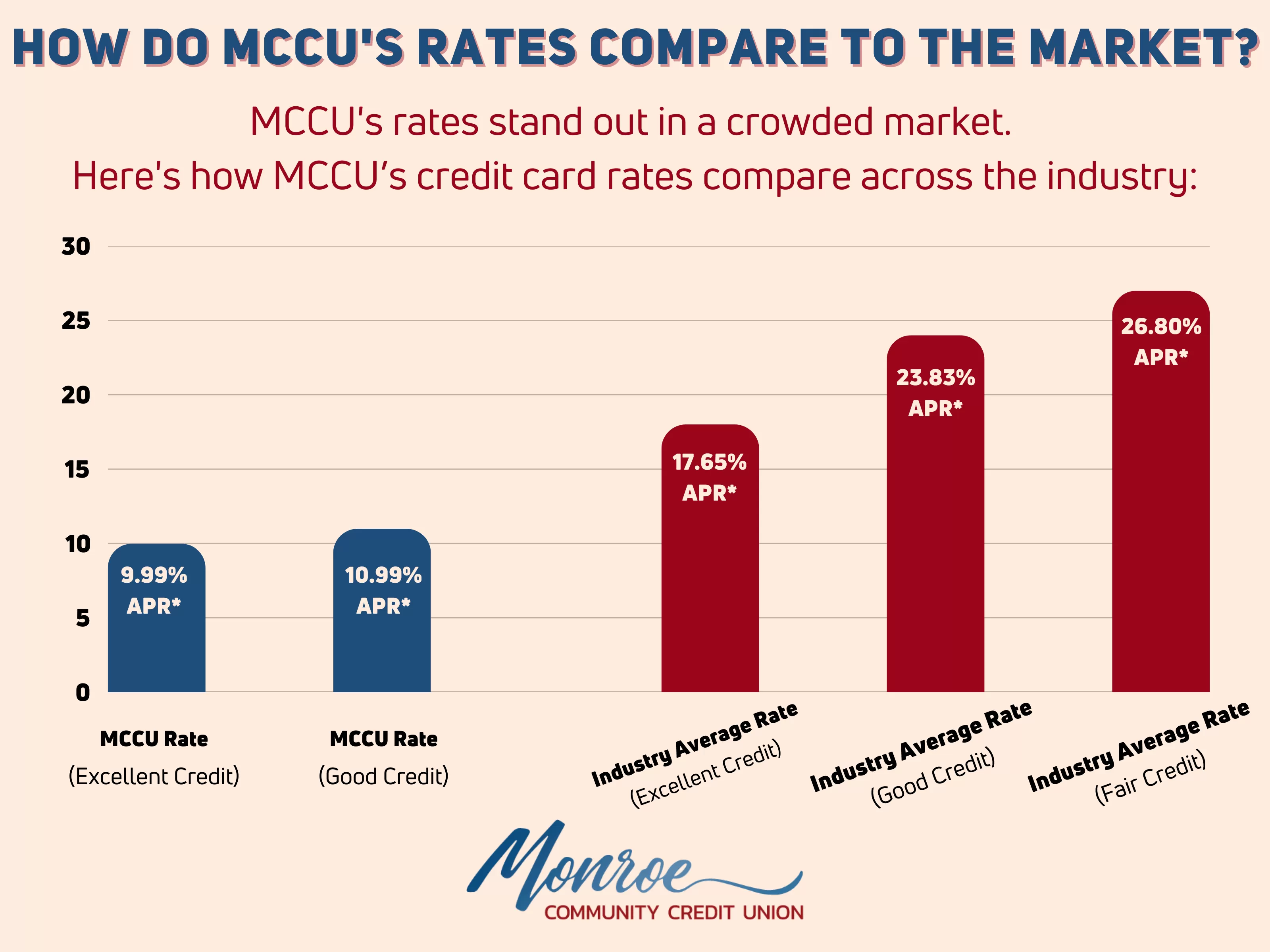

Tired of High Credit Card Rates?

Discover How Much You Could Save with MCCU's Mastercard Platinum Reward Card!

Simplify your financial life with a credit card that offers transparency, competitive rates, and valuable rewards.

Whether you're opening a new credit card or transferring a balance, MCCU's Mastercard Platinum Reward card has everything you need.

Why Choose MCCU's Mastercard Platinum Reward Cards?

MCCU Mastercard Platinum Reward Card Offers:

Competitive Interest Rates: From 9.99% - 17.99% APR.

No Fee Balance Transfers: Save more with $0 balance transfer fees.

No Fee Cash Advances: Access cash without the extra cost.

Earn Rewards Every Time You Swipe: Redeem points with our rewards program for cash back, gift cards, and more.

Modern Payment Options: Use Apple Pay, Samsung Pay, Fitbit Pay, and Garmin Pay.

*APR = Annual Percentage Rate. The APR in our comparisons reflects interest rates on purchases only and excludes introductory rates, balance transfers, cash advances, and fees. For a complete understanding of all costs, please review the full terms and conditions for each credit card. For purposes of this chart, “MCCU Rate - Excellent Credit” is defined as credit scores of 760 or higher, and “MCCU Rate - Good Credit” is defined as credit scores between 720-759. Industry Average Rates obtained from Wallet Hub and pertain to new credit card offers, updated March 2025.

Take the First Step Toward Better Savings with MCCU!

Ready to Make the Switch?

Go to main navigation