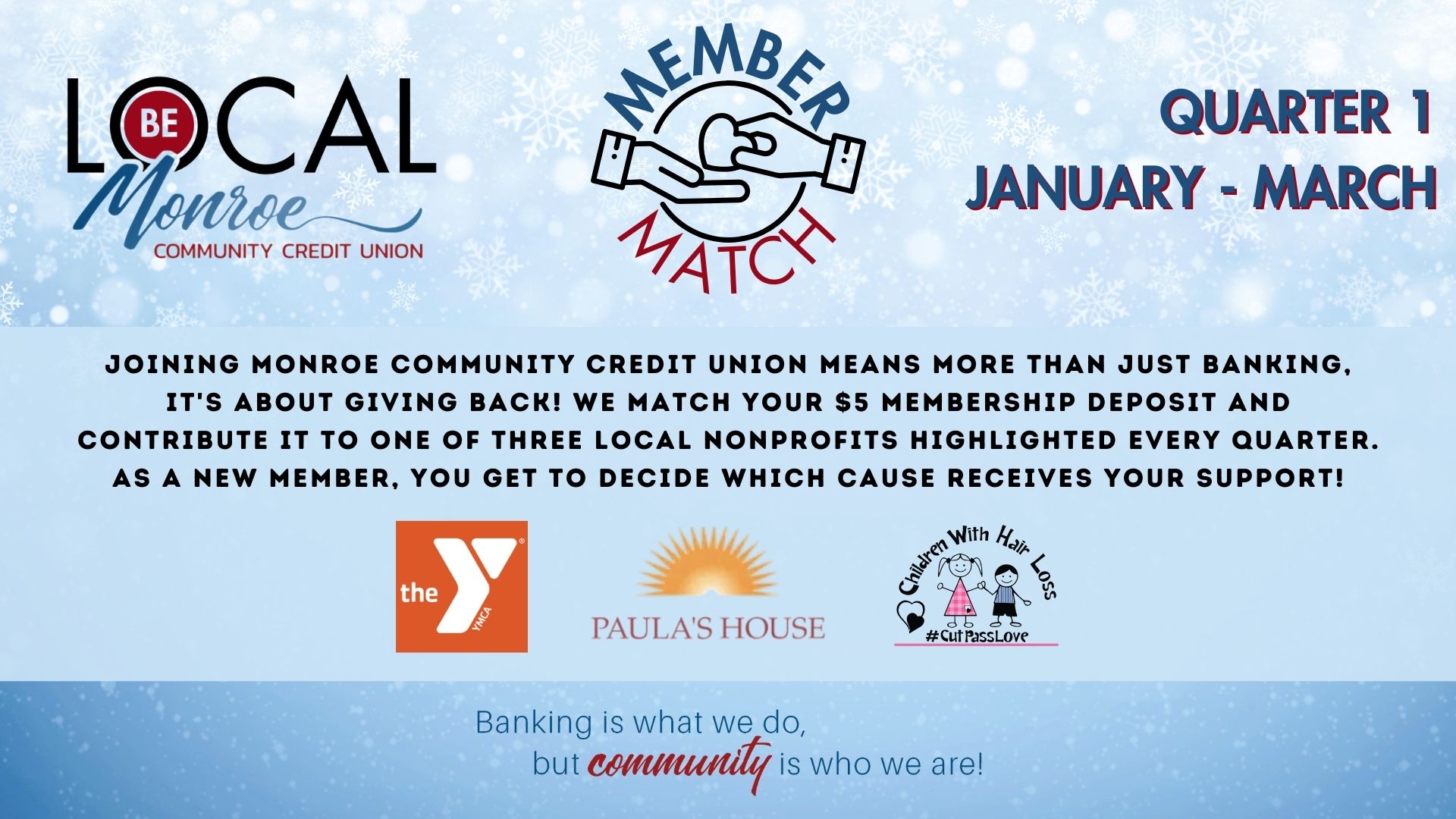

LEARN MORE ABOUT MEMBER MATCH PROGRAM

MCCU’s Annual Meeting will take place on March 18, 2026 at 4 PM at our Main Office (715 N. Telegraph Rd. Monroe, MI 48162).

The committee nominated current incumbents Gary Sievert and Kenny Stritt to serve another term on the board.

To RSVP, please email annualmeeting@monroecommunitycu.org.

LEARN MORE ABOUT MEMBER MATCH PROGRAM